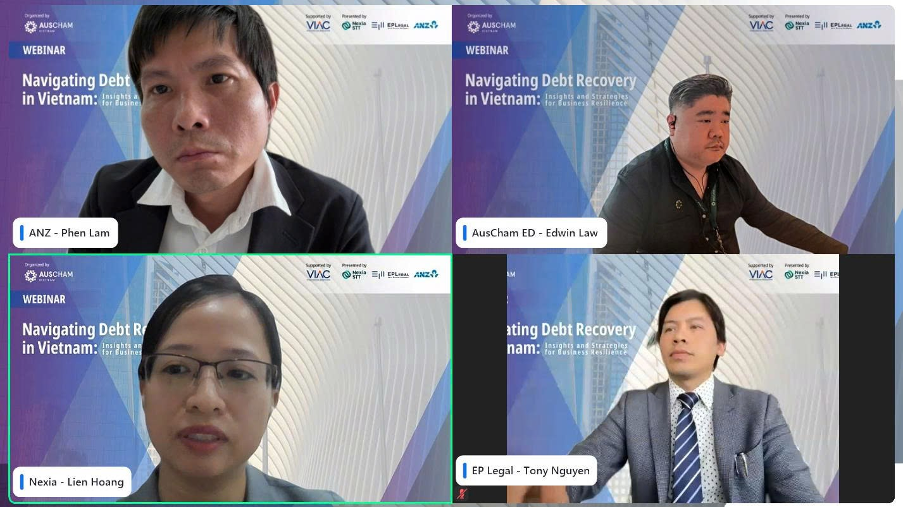

On August 26, 2025, the Australian Chamber of Commerce in Vietnam (AusCham Vietnam), with the support of the Vietnam International Arbitration Centre (VIAC), successfully hosted the webinar “Navigating Debt Recovery in Vietnam: Insights and Strategies for Business Resilience.” The session addressed one of the most pressing challenges facing businesses today – managing and recovering outstanding debts in an increasingly complex commercial environment.

Overview of the webinar

In today's economic context, effective debt recovery is essential to maintaining cash flow, safeguarding operations, and building resilience against financial shocks. Accordingly, this timely discussion proved both urgent and invaluable for Auscham members and stakeholders, with practical strategies and legal insights to navigate overdue payments, reduce credit risks, and protect business sustainability.

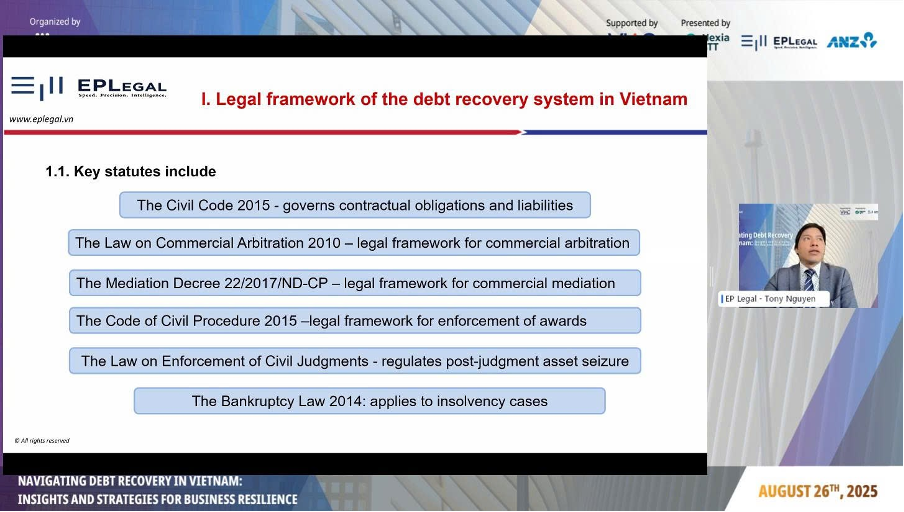

Contributing his perspectives to the discussion, Mr. Nguyen Trung Nam – VIAC Listed Arbitrator, Founding Partner at EPLegal Limited, and Deputy Director of the Vietnam Mediation Centre (VMC), a division of VIAC – shared his insights on debt recovery in Vietnam. His presentation focused on analyzing the legal framework, procedural aspects, common risks, and strategic approaches that businesses can adopt to enhance the effectiveness of their debt recovery efforts.

He highlighted the key legal framework, including the Civil Code 2015, Commercial Law 2010, Arbitration Law, Decree 22/2017/ND-CP on mediation, and the Bankruptcy Law. Since 2020, commercial debt collection services have been banned, leaving businesses with two options: pursuing claims on their own or seeking assistance from professional law firms. Mr. Nam explained the step-by-step process from negotiation and demand letters to litigation or arbitration and emphasized the importance of asset verification before initiating proceedings to avoid unenforceable judgments.

He also emphasized practical challenges such as delays, weak enforcement, corruption risks, lack of reliable credit data, and difficulties in tracing debtors’ assets – especially in cross-border cases, where Vietnam’s absence from the Hague Convention limits recognition of foreign judgments. As strategies, Mr. Nam recommended thorough due diligence, financial safeguards like bank guarantees and Letters of Credit, and prioritizing mediation, which can resolve up to 80% of disputes cost-effectively, with the added advantage that 100% of settlements are voluntarily complied with once a Mediated Settlement Agreement is reached.. He concluded that while debt recovery in Vietnam is complex, businesses can enhance resilience by combining careful preparation with the strategic use of mediation, arbitration, and professional legal support.

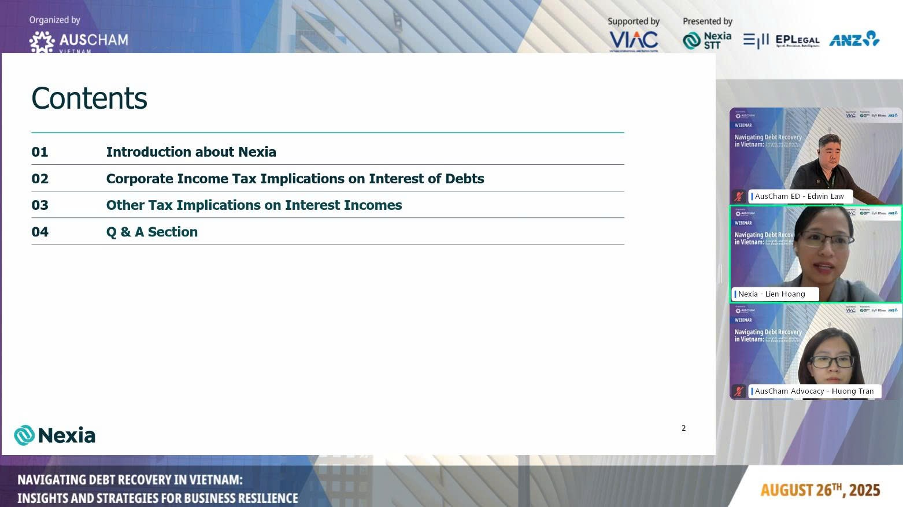

Following the program was a sharing session by Ms. Hoang Thi Hong Lien – Tax Director of Nexia STT Company Limited. Ms. Lien presented on tax regulations related to loan interest, stressing that interest rates must comply with market principles and, starting from October 1, 2025, will be capped at a maximum of 20% per year. Loans exceeding this ceiling, lacking sufficient documentation, or used for improper purposes will not be tax-deductible. She further advised businesses to prepare complete records and supporting documents to minimize tax risks.

Ms. Hoang Thi Hong Lien, Tax Director of Nexia STT, shared her insights at the webinar

From the banking perspective, Mr. Lam Van Phen – Head of Credit at ANZ Bank (Vietnam) Limited, underlined the importance of debt classification and the use of CIC (Credit Information Center) data in customer assessment. He also highlighted persistent challenges in debt handling due to lengthy procedures and the complexity of collateral assets. Nevertheless, he acknowledged that recent legal reforms have helped remove obstacles, and affirmed that in order to sustain credit stability, businesses must adopt transparent, reputable, and effective governance practices.

Mr. Lam Van Phen, Head of Credit at ANZ Bank (Vietnam) Limited, addressed participants at the webinar

The session concluded with an interactive discussion between speakers and participants. Questions centered on tax regulations, dispute resolution through arbitration, and credit risk management. In particular, Mr. Nguyen Trung Nam clarified the advantages of arbitration and the use of VIAC Online Case Management Platform – VIAC eCase, for dispute resolution, while also cautioning against potential risks in registering and handling secured assets. On tax issues, Ms. Lien elaborated on loan interest regulations, especially the upcoming changes effective in 2025, and reminded businesses to strictly comply with contract and documentation requirements to avoid tax liabilities. Meanwhile, Mr. Phen explained how banks monitor portfolios and conduct stress testing to promptly detect non-performing loans, especially amid economic volatility.

Overall, the Q&A session helped shed light on many practical issues businesses frequently encounter, while also providing participants with valuable, hands-on insights into debt recovery in Vietnam. Through their contributions, the speakers offered concrete recommendations to help businesses mitigate legal risks and improve operational efficiency.